https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg files several SR-22’s for clients daily.

https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg has filed 10’s of thousands of SR-22 forms within numerous

Secretary of States. https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg also files SR-22’s fast with electronic filing services usually drivers licenses are reinstated within 24-72 hours.

*Not all states file electronically, however https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg files electronically for all states that have the capability.

Understanding what a SR-22 is.

A SR-22 is not an insurance policy;

it’s simply a financial responsibility form proving that you have

insurance coverage. The SR-22 is filed with your state by your insurance

company and certifies that you carry the minimum liability coverage on

your car insurance policy.

SR-22 for drivers that do not own a vehicle can be filed with a “non-owners” policy.

If you do not own a motor vehicle, you must purchase

“non-owners” liability coverage. This policy provides liability to a vehicle you drive that you do not own. “Non-owners” policies typically are discounted. However, if you purchase a vehicle you must endorse your non-owners policy to an auto policy to remain covered and legal to drive.

The SR-22 must be submitted from

an insurance company licensed in the state for which the SR-22 is required, and has the authority or “power of attorney” to issue an SR-22. Our office

maintains a listing of authorized agents and companies.

An SR-22 requirement can be issued by the Secretary of State based on a judgement in a county court. Depending on the state you live in SR-22’s are usually required for 12-36 months. Some states require these to be consecutive months, meaning that if you are late on a payment you have to start the SR-22 all over. SR22, also known as high risk auto insurance, could be required of drivers for several different reasons, including:

- Driving uninsured

- Driving under the influence (DUI)

- Driving with a suspended or revoked license

- Having an at-fault accident while driving uninsured

- Multiple moving violations or tickets within 12 months

- Being behind on Traffic Citation Payments

- Being behind on Child Support Payments

- Other major moving violations, such as reckless driving

- Unsatisfied judgment suspensions

Keeping a SR-22 Active is the KEY

Lapsing your policy or not paying the payment on time will suspend your license. Some https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg clients opt to pay the 6-12 months of insurance premium in full to avoid suspensions. Other clients opt to pay 30 days in advance, however you choose to pay, just pay before the payment is due to the insurance company, to avoid being arrested for driving uninsured. If you are ever unsure if your policy is active, you can contact your Secretary of State or https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg.

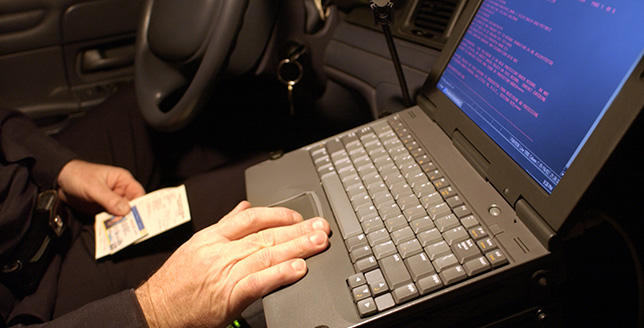

https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg will file the actual SR-22 form with

your state’s Department of Motor Vehicles (DMV) to show proof of

insurance for you. Prior to driving, you should always make sure the SR-22 is on file with the State. Once the SR-22 is filed, your license suspension will

be removed, making it legal to drive again.

Note: SR-22s are state specific — what is required in one state may not apply in another state.

Filing an SR-22 in a different state

Drivers needing an SR-22 that move to a different state need to have a new insurance policy from the new state in which they moved making it difficult to keep their SR-22 filed in the prior state. https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg is able to help people in this situation as long as they live in a state https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg is licensed in the new state and the old state. Not too many agents are able to file SR-22’s in different states because they are not licensed in multiple states.

Switching insurance companies with a SR-22 filing

It is possible to cancel an SR-22, in order to switch to another company. However, https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg suggests getting the new SR-22 on file and then canceling the old policy afterwards, to receive a refund. This means not having to go without a SR-22, and risk driving on a suspension, or having to start over on the time line for which you need a SR-22 with your state.

SR-22 completion

Once the SR-22, or financial responsibility requirements have been satisfied by the state in which you live, you will be notified, as will your insurance company. SR-22’s generally do not cost extra money, it just removes the suspension requirement if your policy were to lapse in the future. https://insurancekingquote.com/wp-content/uploads/2019/06/insurance-king-NASCAR-2.jpg suggests you keep the letter of completion in your glove box for a few months to ensure you do not have any issues with any unforeseen traffic stops.

SR-50.

The Indiana Department of Motor Vehicles requires an Indiana SR-22 or Indiana SR50 insurance certificate to be filed for license reinstatement. Similar to an SR-22 certificate of financial responsibility, an Indiana SR50 insurance certificate (affidavit of current insurance), is a rider to a driver’s primary insurance policy. An Indiana SR50 insurance certificate is a requirement for license reinstatement, as well as a guarantee to the Indiana Department of Motor Vehicles that the driver will remain properly insured for a required period of time. This form shows the Department of Motor Vehicles the beginning and ending dates of the current policy.

To reinstate driving privileges from a mandatory suspension, suspended drivers will be required to pay a reinstatement fee and will be required to have an SR50 form filled out and returned to the Bureau of Motor Vehicles.

If the policy expires or is cancelled, the insurance provider immediately notifies the Indiana DMV by submitting an SR26 filing. This will cause the driver’s license being suspended or revoked again, resulting in additional fines, fees or other penalties.

Usually, drivers under this requirement are expected to carry Indiana SR50 insurance for a period of three years, keeping it in effect with no lapse in coverage.

Offenses that require Indiana SR50 insurance include:

- DUI or DWI offense

- Refusal to take a breath or blood test

- Operating an uninsured vehicle / uninsured accidents

- Multiple driving offenses / excessive points on a driver’s record

- Child support or neglect cases

- Legal judgments

- Indiana SR50 insurance can be purchased as an owner/owner-operator policy for those who own a vehicle, or as a non-owner policy for those who do not own a vehicle.

Indiana minimum required insurance coverage limits:

- Uninsured Motorists: Bodily Injury: $25,000/$50,000

- Property Damage: $10,000

- Under insured Motorists: Bodily Injury: $50,000